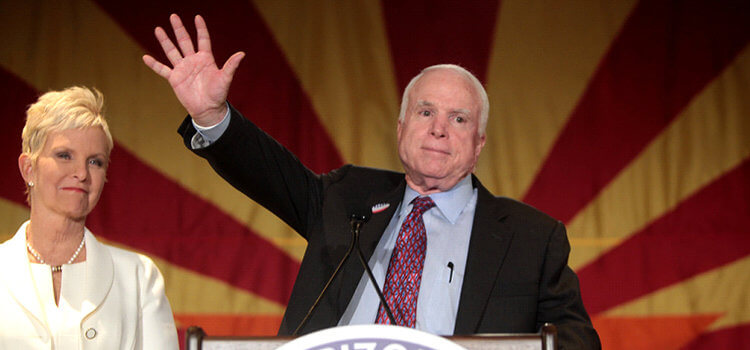

United States Senator John Sidney McCain III was highly esteemed by many, both republicans and democrats alike. At 81, he ultimately passed away on August 25, 2018, due to Glioblastoma, an aggressive type of brain cancer. He is survived by his wife, Cindy, whom he was married to for nearly 40 years, his seven children, five grandchildren, and his 106-year-old mother, Roberta.

In his final days, McCain has reportedly been spending a lot of time at his ranch home in Sedona, Arizona. What you may not know is that McCain also left behind a hefty estate, amassed by him and his wife over the years. This wealth includes a sprawling real estate portfolio, a remarkable career in public service, author of several books, founders of several charitable organizations and a sizeable automobile collection. Here’s a closer look into John and Cindy McCain’s estate and how effective estate planning tools can help you make the most of your fortune:

John McCain’s Net Worth

McCain left behind a remarkable career in public service. After his tour of duty in Vietnam and his long captivity as a prisoner of war, McCain dedicated his life to Congress as a United States Senator from Arizona. McCain is reportedly worth $16 million, according to Celebritynetworth.com, although Cindy McCain is an heiress herself of Hensley & Co., the largest Anheuser-Busch distributor. The 2018 standard salary for a member of Congress is $174,000. In 2007 McCain earned $1.7 million, which he donated to charity, from the book sales of “Hard Call: The Art of Great Decisions.” His newest memoir, “The Restless Wave,” was released in May 2018. McCain received over $70,000 from his Navy pension in 2015. His other significant earnings have come from the purchase and sales of various real estate properties.

Net Worth and Estate Tax

According to IRS.gov, “The Estate Tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at the date of death.” As of April 2018, the federal estate and gift tax limit is $11,180,000 per person. This means that if an individual dies owning more than $11,180,000 in assets, his heirs must pay an estate tax on anything they inherit above that sum. Individuals with a high net worth, such as McCain, must seek the advice of an experienced estate planning attorney to properly structure any assets owned in their name so as to minimize estate tax implications for their families.

Real Estate Properties and Probate

John McCain’s family boasts a substantial real estate portfolio that spans many years and many states, including Arizona, California, and Virginia. These properties included ranches, beachfront condominiums, downtown condominiums, and even Cindy McCain’s childhood home in Phoenix. They were mostly owned by Cindy McCain, her dependent children and the Trusts they control.

Trusts, both Revocable and Irrevocable, are essential to avoid probate when passing real estate to heirs. A “Revocable Trust” is a primary estate-planning tool that is used in place of a standard Last Will and Testament, in order to by-pass probate. Probate, or probate administration, is a court process that passes ownership of the decedent’s assets to their family or listed beneficiaries. Having a properly funded Trust means that upon your death, all assets in the Trust, including real estate, pass to the beneficiaries through the Trust, and not through any court process. Avoiding probate also means significant savings in court costs and attorney’s fees for the family.

John McCain’s Primary Residence and Homestead in Florida

The McCains spent a lot of time at their ranch in Sedona, Arizona, but their primary residence is a condo in a 12-story glass building in downtown Phoenix. They reportedly spent $4.67 million on this high-floor apartment in 2006 and later bought the unit below for $830,000, for the purpose of combining the two.

The use of a primary residence is a very important estate planning tool in many states. If your primary residence is in Florida, you should be aware of the benefits. In Florida, if a person properly applies for “Homestead” with their local county, their primary residence is referred to as “Homestead Property.” The Florida Homestead Exemption reduces the taxable value of that real property by up to $50,000 and also caps the fair market value growth, for tax purposes only, so as to keep your property taxes from skyrocketing in any given year. Other benefits include creditor protection so that most creditors (some exceptions apply such as the IRS, condominium associations, and mechanic’s liens) cannot attach a lien to the property. This means that homestead offers both tax breaks and peace of mind.

Specific Bequests and Charities

John McCain also had a sizeable car collection, which included: a Cadillac CTS, a Volkswagen convertible, Jeep Wrangler, Lincoln, Ford pick-up truck, Lexus, among others. An efficient way to transfer a car, boat or other motorized vehicle to a family member is through a specific bequest by naming a specific person in either a Will or a Trust.

Ultimately, John McCain’s legacy was one of generosity. He dedicated most of his life to serving our country while donating a significant portion of his wealth to charity. Nearly $9 million in unused donations from his 2008 presidential bid was transferred to charity. The family regularly donated to local chapters and national nonprofits. Champions of learning and literacy, most of the family’s contributions were earmarked for education. The schools attended by McCain’s children were the main beneficiaries over the years, in addition to the family’s McCain Institute Foundation and Arizona State University Foundation. Charitable giving is another common estate planning technique that can provide certain financial, as well as personal, benefits.

Contact OC Estate and Elder Law at (954) 251-0332 or info@ocestatelawyers.com to learn how effective estate planning can help you make the most of your wealth and honor your loved ones.